For many years the question of “where to invest” has throbbed the minds of young investors. As the criteria involved are Return On Investments (ROI), Flexibility of withdrawal, Ease of investment, Safety of deposits & Tax savings – the most obvious choices will narrow down to LIC and mutual funds. Many will even reach out for Mutual Funds (MF) after reading those lucrative blog posts, projecting MF as the “one stop solution for all their financial needs”.

In this article let us find out how far this is true. Also we will discuss 5 areas where LIC can be a better investment opportunity than many of us ever thought.

How it begins! A real life scenario

A recently married, educated, happy young couple moves into their Dream Home in the beginning of their life by availing home loan. They have a new tax, called “property tax”. Next they buy a New Car, New Furniture and New Home Appliances to match their new house, their debts go up! The liabilities column in their balance sheet, which was nil earlier, is now full of mortgages and credit card debt.

In their late thirties, they wake up and decide that all the loans has to be closed. They reach out for the so called financial advisers to understand that Mutual Funds are awesome for gains and they run behind them. But in fact their risk appetite may not permit for a mutual fund scenario at all. This is the reason, why many don’t have a happy ending story, when it comes to their finances.

5 Benefits LIC offers, which hardly people know

We will discuss them one by one.

Regular Savings: the key to Financial Upliftment

A famous saying is “Every one wants to park their vehicles in shade of trees But… No one wants to grow trees!”, similarly every one wants to RETIRE RICH But…No one wants to Invest Money when they are young!

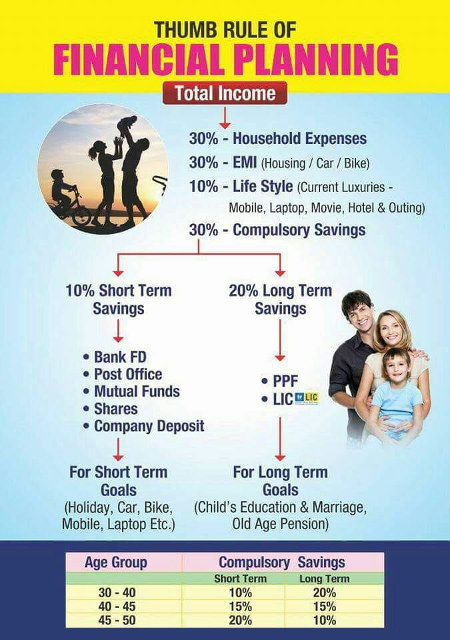

Fig.1 – thumb rule of financial planning

Fig.1 – thumb rule of financial planningMost average investors know only about

1.Investing only in mutual funds / picking only blue-chip stocks

2.Bad debt – which is why they try to pay it off

3.Bad losses – Which is why they think losing money is bad

4.Bad Expenses – which is why they hate paying bills

It is true that there are several financial instruments today that can generate good returns on commitment of a long-term investment. In fact Insurance, Mutual Fund & Shares are called Financial Assets.

FINANCIAL DISCIPLINE, is a plan, that is self designed and self agreed rule. Good financial discipline create more wealth than even financial intelligence. Regularity is the key to wealth, not financial intelligence.

How much one ought to save?

As a rule of thumb the below chart will show you how much one need to save based on their monthly income

| Monthly Income | Accumulation/Ability to Pay | Living Expenses | Welfare/ Family Status |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | LIC | Speculative (MF, Stocks etc.) |

Fund Total | % | Food | Shelter | Cloths | Maintenance | Total | % | Education &Recreation | |

| 15,000 | 5 | 750 | 0 | 750 | 90 | 8,000 | 3,000 | 1,000 | 1,500 | 13500 | 5 | 750 |

| 18,000 | 6 | 1,080 | 0 | 1,080 | 87 | 9,280 | 3,480 | 1,160 | 1,740 | 15660 | 7 | 1,260 |

| 20,000 | 8 | 1,500 | 0 | 1,500 | 85 | 10,015 | 3,756 | 1,252 | 1,878 | 16,900 | 8 | 1,600 |

| 25000 | 10 | 2,500 | 0 | 2,500 | 78 | 11,556 | 4,333 | 1,444 | 2,167 | 19,500 | 12 | 3,000 |

| 30,000 | 10 | 3,000 | 0 | 3,000 | 76 | 13,511 | 5,067 | 1,689 | 2,533 | 22,800 | 14 | 4,200 |

| 35,000 | 15 | 5,250 | 0 | 5,250 | 71 | 14,726 | 5,522 | 1,841 | 2,761 | 24,850 | 14 | 4,900 |

| 40,000 | 15 | 6,000 | 0 | 6,000 | 71 | 16,830 | 6,311 | 2,104 | 3,156 | 28400 | 14 | 5,600 |

| 50,000 | 15 | 7,500 | 0 | 7,500 | 70 | 20,741 | 7,778 | 2,593 | 3,889 | 35000 | 15 | 7,500 |

| 55000 | 20 | 15,000 | 0 | 15,000 | 65 | 28,889 | 10,833 | 3,611 | 5,417 | 48,750 | 15 | 11,250 |

| 1,00,000 | 20 | 15,000 | 5,000 | 20,000 | 64 | 37,926 | 14,222 | 4,741 | 7,111 | 64,000 | 16 | 16,000 |

| 1,25,000 | 30 | 30,000 | 7,500 | 37,500 | 54 | 40,000 | 15,000 | 5,000 | 7,500 | 67,500 | 16 | 20,000 |

| 1,50,000 | 35 | 42,500 | 10,000 | 52,500 | 49 | 43,556 | 16,333 | 5,444 | 8,167 | 73,500 | 16 | 24000 |

| 2,00,000 | 35 | 60,000 | 10,000 | 70,000 | 47 | 55,704 | 20,889 | 6,963 | 10,444 | 94000 | 18 | 36,000 |

| 2,50,000 | 40 | 80,000 | 20,000 | 1,00,000 | 42 | 62,222 | 23,333 | 7,778 | 11,667 | 1,05,000 | 18 | 45,000 |

| 3,00,000 | 40 | 80.000 | 40,000 | 1,20,000 | 42 | 74,667 | 28.000 | 9,333 | 14000 | 1,26,000 | 18 | 54.000 |

| 4,00,000 | 45 | 1,30,000 | 50,000 | 1,80,000 | 35 | 82,963 | 31,111 | 10,370 | 15,556 | 1,40,000 | 20 | 80,000 |

| 5,00,000 | 50 | 1,75,000 | 75,000 | 2,50,000 | 30 | 88,889 | 33,333 | 11,111 | 16,667 | 1,50,000 | 20 | 1,00,000 |

Table 1.How much money do I need to save – Illustration

Safe return of 6.5% even after 20 years

On the contrary Rate of interest per annum falls to 10-11% for Corporate Fixed Deposits, Non Convertible Debenture, Draw investors Wary of Debt Mutual Fund etc.

The reasons postulated are

- Fixed Deposits with AAA rating such as LIC Housing Finance, HDFC Ltd, Bajaj Finserv & Mahindra Finance which fetch 8 to 9% returns.

- Over the past one year, debt Mutual Fund Schemes have written off their investment in IL& FS resulting in NAVs of these schemes eroding.

- Returns from debt mutual funds have diminished due to rating downgrades & defaults.

- As a result, investors who worry about new flies in Mutual Fund and looking for absolute safety are opting for combinations of company Deposits and high rated NCDs.

Over the past 20 years,the average stock market Mutual Fund gained 13% CAGR, But the average Fund investor earned only 3.5% – Mark Skousen (Economist)

SEBI issued 47 warning letters to mutual fund

(MF) houses in the last financial year, and the watchdog in consultation with the central government is examining various issues related to MFs on continuous basis. In a written reply to the Lok Sabha, Union Minister of State for Finance and Corporate Affairs Anurag Thakur said SEBI, in its regulatory supervision, has noticed various irregularities with respect to functioning of MFs such as failure to identify and appropriate all the expenses in individual schemes as per regulatory requirements, and accordingly issued 47 warning letters and 24 deficiency letters during 2018-19 to MFs and AMCs. – courtesy PTI july 15 2019

More chances of Continuation

Everybody starts investing with a purpose. A no purpose investment within itself is a failure! The general purposes people invest are buying a loan free home, securing funds for children’s higher education, funds for daughter’s marriage, pension corpus for old age etc. As we all know, these scenarios involves 20 to 25 years of persistent saving. One is free to invest anywhere for their future plans. Yet the number of people continuing with their LIC policy till the stipulated period are 90-95%; where as people holding their Mutual Funds that far are just 20-25%.

Experts suggest 3 reasons for this slide in MF investors.

Profit Booking or Profit Taking

A condition in which the MF holder liquidates their funds to cash out the profit involved. Say for eg. one had brought the funds with NAV 50 rupees and now they understood that NAV runs 100 rupees, many will en-cash the opportunity!

They made a profit, that is true. Consequently they lost the focus! Think of it. The money one needed for the grand marriage of their daughter after 20 years has come today. An untimely money coming to one’s account will definitely erode, without serving the definite purpose. Reason: we we live in a world of “Needs”.

Factors affecting profit booking are company specific news, government policy changes, sector specific news. Click here a more wide reading.

Panic Selling

This scenario results when investor sells off his funds with little regard for the price. A sudden news of management change in a blue chip company can trigger its recursive waves across the market and under those circumstances many will sell off their holdings for cheap rates. Some may hold for a while. But if the NAV falls beyond one’s mind threshold value, no body can stop them.

Not only they lost, but also they diverted from their focus! They may not have the courage and time to restart savings.

Purchase

Sensex is sentimental. So are the purchase decisions. Determine exactly what went wrong and how you can avoid the same mistake in the future. So one need to aggressively monitor their Investments. Expect and react to change. No bull market is permanent. No bear market is permanent. And there are no stocks that you can buy and forget. The pace of change is too great. Being relaxed, as Hooper advised does not mean being complacent.

How much time one is ready to invest along with money for 20-25 years?

On the other side people starting an LIC policy are more liable to continue till the end for reasons such as

- As the person grows, they become more financially aware and socially responsible

- The stringent rules of LIC regarding surrender

So it becomes evident that, Mutual fund investments are risky but good for quick bugs scenarios like one week foreign trip or making funds to pay off credit card liability. It may not be suitable for arranging funds for long term goals, at least to many of us.

Guarantee for one’s investment

No one bothers to read the offer documents coming along with Mutual Fund investments. All Mutual fund offer Documents are similar and shocking. Their document disclaimer part in general says

The In the preparation of the material contained in this document, the Asset Management Company (AMC) has used information that is publicly available, including information developed in-house. Some of the material used in the document may have been obtained from members/persons other than the AMC and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gathered and material used in this document is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. We have included statements / opinions / recommendations in this document, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to,but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc. The AMC (including its affiliates), the Mutual Fund, the trust and any of its officers, directors, personnel and employees, shall not be liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. The recipient alone shall be fully responsible/are liable for any decision taken on this material.

The highlighted lines reiterates that they will not stand by any single statement they make in their presentations.

On the contrary the policy document issued by Life Insurance Corporation of India (LIC) is a contract and is having legal validity. Meaning, if tomorrow LIC is deviating from the contract, we can approach the cout of law. Here are the sample benefits quoted from the famous Jeevan Anand policy.

| Scenario | Benefit |

|---|---|

| On death of the Life Assured before the end of stipulated Policy Term, provided the policy is in full force by paying upto-date premiums. | Death benefit, defined as sum of “Sum Assured on Death” and vested Simple Reversionary Bonuses and Final Additional bonus, if any, shall be payable. Where, “Sum Assured on Death” is defined as higher of 125% of Basic Sum Assured or 10 times of annualised premium. This death benefit shall not be less than 105% of all the premiums paid as on date of death. The premiums mentioned above exclude tax, extra premium and rider premiums, if any. |

| On death of the Life Assured after the end of the stipulated Policy Term, provided the policy is in full force. | Basic Sum Assured shall be payable. |

| On Life Assured surviving at the end of the Policy Term (i.e. on maturity), provided the policy is in full force by paying upto-date premiums. | Basic Sum Assured along with vested simple reversionary bonuses and Final Additional bonus, if any, shall be payable. |

Tax Free Entry! Tax Free Exit!

Premiums paid are tax free under 80(c).

Maturity is exempted under 10(10(D)).

After All

In any event, Life Insurance is the Protector of your wealth fund and Mutual Fund is the creator of the wealth fund. Life Insurance Works, there is no substitute for it…not bonds, not stocks, not mutual funds, not real estate, and not even limited partnerships.

So is Life Insurance Corporation of India (LIC). Your best friend for a life time!